The DOW recovered from early losses overnight, to finish quite flat (0.08%), as the market continued to digest global banking worries. Energy stocks also dragged on global markets, with oil reversing previous short term gains, large falls were seen over continued concerns of an increasing supply glut.

We are expecting our local market to open quite flat today. The carnage yesterday which stemmed from fears over the going concern of European bank Duetsche Bank, the accelerated losses on our market looked like panic selling and margin calls, most likely from bank related stocks. These type of markets will test investors patience, however will also create significant opportunity.

Head Investment Officer at Airlie Funds Management John Sevior, and arguably Australia’s best well known stock picker has commented in the AFR this morning that his fund has now started to actively exit their large cash position. “We’re more on the front foot now in terms of putting our cash to work than we have been in more than 10 months,” he said, adding that Airlie could be fully invested by the end of the year should the opportunities arise. Sevior’s fund has been among the highest cash balances of any funds management firm in the country. Interestingly Sevior also mentioned that he was also considering investing in resources for the first time since his fund started in 2012.

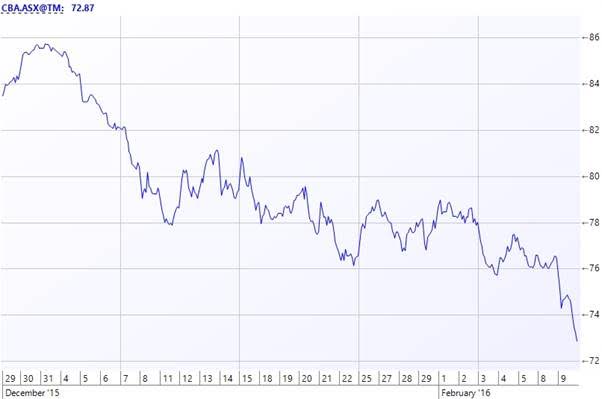

Commonwealth Bank was the first of the banks to report today, which reported a decent result in light of the recent volatility. The bank’s return on equity fell from 18.6% to 17.2% which was largely expected from compliance of the new BASEL 4 regulatory standards, the result was slightly ahead of expectations. The flat dividend and net interest margin probably points out that the banks are going to continue to find it difficult to grow at the same rate as previous years.

Figure 1: CBA 1 Month Chart – Has CBA been oversold prior to a positive result?