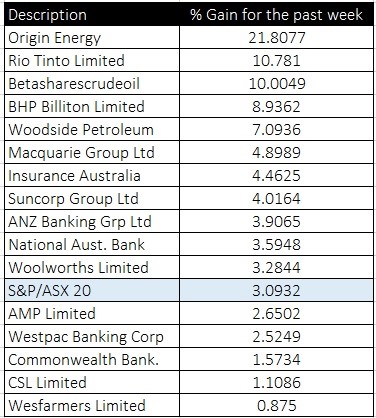

The market action of the past few weeks continues to amaze us due to the moves week to week, examples last week included Santos +34.7%, Origin +21.8%, RIO +10.78%, OOO (oil) +10.00% and BHP +8.94% (see figure 1). All these moves are hard to pick, and shows the level of hedge fund selling and buying within very short time frames. This trend is also mixing with renewed global interest in commodities. The main skill investing in these markets remains fundamentals, and discounting the emotional uncertainty caused by some of the financial media noise.

The damage caused by a Glencore style of stock move gives us all an amazing opportunity to look at assets like BHP & RIO. These two Australian companies remain well positioned for the future, and remain under the strong stewardship of CEO’s like Sam Walsh. The problems facing Glencore and Rio are similar, however RIO’s balance sheet is vastly different. Sam Walsh’s focus on cash earnings and cost cutting have this business very well position for this cycle.

The ASX 200 has now recovered nearly 250 points in the past few weeks, and is probably due for a period of consolidation. With the index at 5,279, we think the best allocation strategy is now back to more selective buying, rather than broad based index buying. Best Buys remain: Magellan (MGE), Perpetual, Telstra, Slater & Gordon, Qube, Woolworths and Xero.

Figure 1 – ASX 20 Rolling Week