The Dow closed slightly down last night (-0.29%), which broke 7 positive days in a row. Our market is also expected to open slightly lower, which will see the trend of profit taking over the past two days continue.

Westpac is officially the last of the Big Four Banks to raise capital. Westpac today announced it will raise $3.5 billion through a pro rata accelerated renounceable entitlement offer, with an offer price of $25.50. While this offer seems fairly comparable to the other banks’ recent issues, what was most surprising was the bank will not only lift its mortgage rates for property investors, but it will also increase owner occupiers mortgage rates by 20 basis points. This is quite surprising given that most lending institutions have been ramping up their efforts to secure owner occupier mortgages, however making it more difficult for property investors to secure finance. This decision most likely reflects the fact that Westpac holds the largest exposure to residential mortgages of the Big Four.

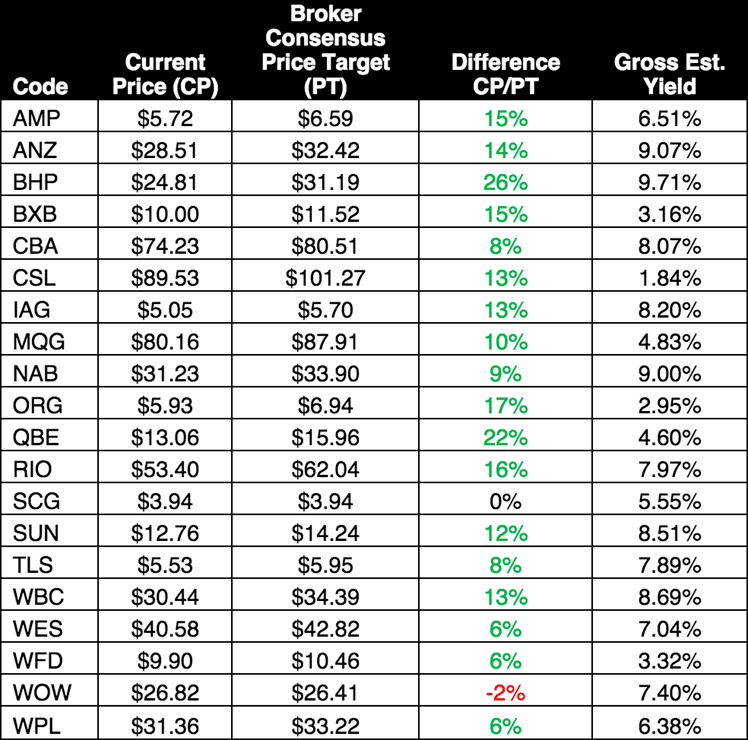

While global markets continue to trade with volatility, our view of the domestic market remains largely unchanged. There is broad value in our market under the 5,200 point level, and if you have a long term view, buying the right companies at this point in time can set your portfolio up for strong future gains. As can be seen below, the average broker consensus of the ASX 20 companies are nearly all trading at large discounts. Further, the ASX 20 estimated gross dividend yields comparable with Term Deposit rates strongly supports these valuations.

Figure 1 – ASX 20 Average Broker Consensus & Gross Estimated Yields (incl. Franking)