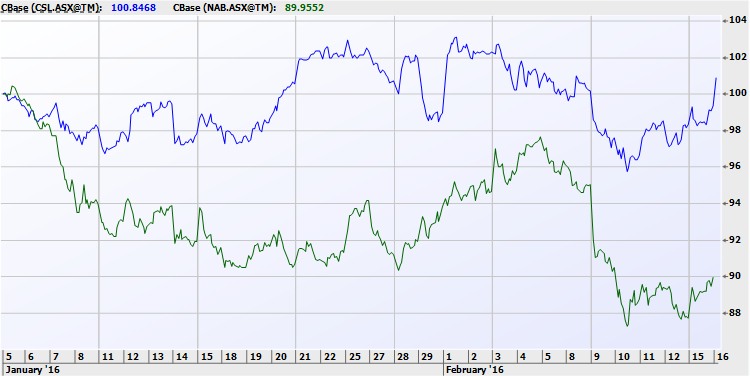

Local shares look set to extend Monday’s advance as European stocks rallied, paced by banks and car makers. SPI futures were up 25 points, while the $A was up 0.6% at 4am Sydney time. Also oil was up overnight on reports that energy ministers from Russia, Saudi Arabia and Venezuela are gathering in Qatar for a meeting amid speculation that the persistent low price for the commodity has started to encourage the biggest producers to push back with the potential for some sort of coordinated output cut. In Australia the focus will be on local earnings with NAB and CSL topping Tuesday’s schedule for reporting. NAB, fresh from the $3.2 billion demerger its UK business, has posted an 8% rise in cash profit to $1.7 billion for the December quarter. The cash profit is approximately 3% above the quarterly average of the September half year result, and puts the bank well on track to beat last year’s $5.84 billion full year cash profit. The most significant news for the bank moving forward is the $5.5 billion raised last year, the biggest capital raising in Australian company history. This has put them in good stead to meet APRA’s stricter capital rules designed to make Australian banks safer from any future financial crisis. We continue to hold NAB in our portfolio’s and accumulate in portfolio’s underweight banks. CSL also delivered a strong result with a 3.8% jump in first half net profit to $US718.8 million ($1 billion) as the company’s new flu business, Seqirus, delivered its first sales. Earnings per share were up 9% and cash flow up 8%. CSL also declared a flat interim dividend of 58¢. We continue to mildly reduce CSL with any significant price increase. Even with these two large companies reporting well we remain cautious of the volatility still in the market, as investor sentiment can currently shift on whims that are not based on fundamental information.

Figure 1- CSL and NAB common base rolling 30 days |