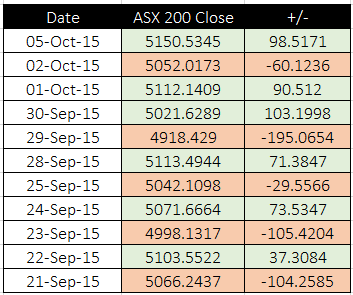

The daily moves in the DOW continues to exhibit high levels of volatility, and really gives you little insight into the state of play of US companies and their economy. The over analysis of US rate rises for December 2015 or early 2016 has dominated market trading, and hedge funds appear to be very active in trading strategies between credit and equity markets. The recent example of Glencore which jumped nearly 70%+ in Hong Kong yesterday, shows the extremes we all have to deal with day to day as hedge funds and computerized trading dominate. This elevated volatility is also being seen in the Australian market, with big falls and bounces becoming more common (See Graph 1). Taking advantage of these recent market falls is working with the right stocks, but they need to be supported by reasonable business and valuation cases.

The commodities space is a good example, BHP & RIO’s balance sheets remain well positioned to endure this current market phase, although we are not sure the same can be said for Fortescue and Glencore. The level of debt these business carry is likely to be the determining factor for them in the next 2 years. Likewise, the US shale oil industry is running out of time with the oil price, they really need a $50-70 a barrel outcome, and remain highly indebted to banks and US bond holders. However, the strategic importance of this industry means the US have been less reliant on Crude Oil from the Middle East. The current situation with Russia, Iran and Syria has important implications for global oil and the US, and we can see no other outcome than a likely rally in the oil price going into the US winter. OOO.AXW (Oil ETF) and Woodside remain our key Energy holdings.

At the portfolio levels it is good to see Medibank Private continuing its rally, finishing at $2.50 yesterday. This stock continues to see good buying on the back of a potential review of Medicare, and we have now raised our long term target from $2.65 out to $2.90. Medibank’s balance sheets remains ungeared, and the cost out story remains alive and well.

Figure 1 – ASX 200 – Recent large daily swings in our market